For centuries Sri Lanka has been a global trading hub of luxury goods and a melting point of Western and Eastern cultures, where sailor merchants from East and West met to trade goods and exchange knowledge.

Our potential to become an important transhipment hub, a central location where many shipping lines consolidate and de-consolidate cargo for transportation to other destinations is reaffirmed by many internal and external key factors including;

Situated on a key East-West trade route and set close to Indian Peninsular and the leading markets in Asia-Pacific and African regions, Sri Lanka possesses the essential locational advantage to become the key logistics hub in South Asia.

As the leading maritime hub of the South Asian region, cargo originating from and destined to Europe, East and South Asia, the Persian Gulf and East Africa is conveniently connected through the Colombo and Hambantota ports. In addition, Sri Lankan seaports are conveniently located on the path of ‘One Belt One Road’ (OBOR) initiative launched by the China Merchants Group, a state-owned corporation.

Situated only 10 to 12 nautical miles from the main Indian Ocean shipping routes linking the Suez Canal and the Malacca Strait, the Magampura port in Hambantota, in particular, has a growing importance in the OBOR initiative, predicted to be the 21st Century Maritime Silk Road of trade.

Following the end of the three-decade-long war in Sri Lanka, the country has seen a wave of logistics infrastructure development like never before.

Sri Lanka’s Colombo Port has the capacity to handle 20 million TEUs per annum, with a throughput of nearly 8 million TEUs per annum and serves 33 major shipping lines.

To accommodate the growing demand for marine logistical services, the Sri Lankan government has launched the Colombo Port Expansion Project which will add three more container terminals increasing the total number of terminals to six. The South Asia Gateway Terminal (SAGT), the first terminal to commence operation under the new expansion is also the first terminal in South Asia that can accommodate mega-sized vessels.

Completion of the ambitious Colombo Port Expansion Project would increase the container handling capacity of the Colombo Port to a 12 Million TEUs per year making it one of the largest container ports in the world.

Today, Colombo Port is the ;

Country’s Hambantota port has a unique geographical factor that most of its neighbouring ports lack, namely a deep-water coastline close to Indian Ocean Shipping Lanes, conducive to handle the world’s largest container ships and supertankers.

In addition, Sri Lankan Customs has the ability to handle volume growth with Electronic Data Interchange (ASYCUDA World) allowing speedy customs clearance and real-time management of information,

Sri Lanka has also launched a series of energetic plans to expand its air navigation capabilities. Mattala Airport is one of the first international airports to be developed under Sri Lanka’s infrastructure expansion programme. At present, the country’s air travel infrastructure includes 5 international airports and 18 domestic airports. The Bandaranaike International Airport in Colombo has a passenger movement of 10.7 million per year and a cargo movement of 253,100 metric tons per year with the capacity to handle more. Meanwhile, the Mattala International Airport also has the capacity to handle 45,000 metric tons of air cargo per year. In addition to the expansion of its sea and airports, the country also has one of the highest road densities in South Asia, with 173.9 km of roads per 100 square km of land, connecting all major seaports and airports.

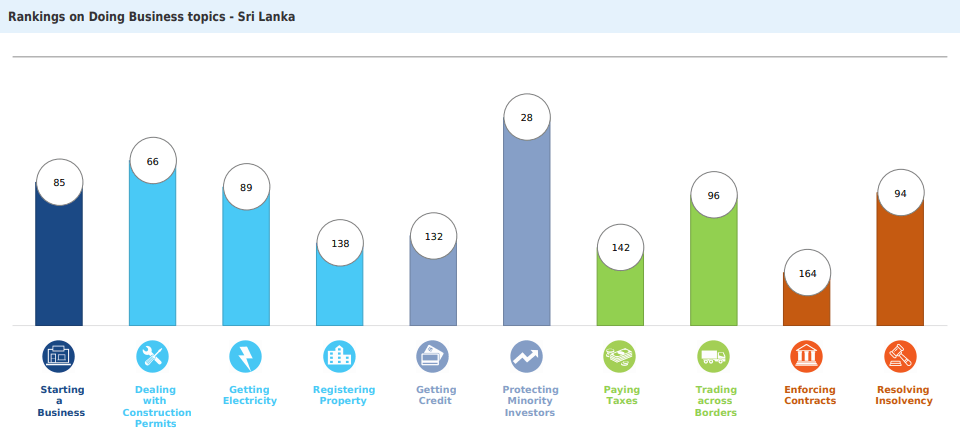

Sri Lanka was ranked 99 in the Ease of Doing Business index out of the 190 economies in the world, with an overall doing business score of 61.8. In relevance to the logistics sector, the trading across border factor is Sri Lanka was ranked at 96th position with a score of 73.3.

Sri Lanka has also established free Ports and Bonded Areas at major shipping and airports to facilitate Sri Lanka's import and export of goods and services with freedom to carry out transactions in convertible foreign currency.

Our free trade agreements with South Asian countries under SAFTA, and with Singapore, as well as country’s participation in the Generalized System of Preferences (GSP), allows free movement of goods to involved recipient countries without taxation.

The commercial hub regulations introduced in 2013 also facilitates entrepot trade under two categories;

| Entrepot Trade under the Commercial Hub Regulations in Gazette Notification No. 1818/30 of July 11, 2013 | Entrepot Trade under the Customs Ordinance | |

|---|---|---|

| Minimum Investment in Fixed Assets | US$ 5 million within 1 year from the BOI Agreement. 65% of the total investments should be made from foreign sources. | Not specified |

| Annual re-export/ turnover | Not less than US$ 20 million in 5 years from the date of commencement of operations | No minimum requirement |

| Designated Locations | Designated Free Ports, Designated Bonded Areas and Specified Bonded Areas | Bonded areas in ports and airports under Customs supervision |

Sri Lanka practices a variety of trans-shipment methods including Hub-and-Spoke, Interlining/ Intersection, and Relay. Sri Lanka also provides auxiliary maintenance and replenishing services including dry and wet dock repairs, crew changes, supplying and replenishing victuals and water.