Rapid technological advancements, growth and development of the IT industry, post-pandemic market dynamics and the resultant increase in global market opportunities for Electrical and Electronics products are at much higher levels than they have ever been. A clear understanding of ‘where and for what’ the global market demand is, helps the Electrical and Electronic exporters in curating their future expansion and growth strategy to align with such demand and opportunities.

As an identified focus sector that is expected to contribute immensely towards an export-led economic growth, the Electrical and Electronic industry in the country draws special attention from the state. Extremely attractive tax and duty concessions, combined with numerous free trade agreements, preferential market access arrangements and many other enablers, presents the exporters with an ideal platform to grow lucrative export businesses within this sector.

In 2020 the worldwide sales from electronic circuit component exports totalled US$783.6 billion.

The overall value of exported electronic circuit components increased by an average 49.9% from all exporting countries since 2016 when electronic circuit component shipments were valued at $522.9 billion. From 2019 to 2020, electronic circuit component exports appreciated by 11.6%.

By value, the 5 biggest exporters (Hong Kong, Taiwan, mainland China, Singapore and South Korea) generated 71.9% of the world’s overall shipments of electronic circuit components during 2020. That percentage shows the high concentration within the worldwide electronic circuits industry.

Among continents, suppliers in Asia sold the highest dollar worth of exported electronic circuit components on international markets during 2020 with shipments valued at $686 billion or 87.5% of the global total.

According to the National Export Strategy (NES) a few carefully selected products lines have been established as focus areas in consideration of a few critical factors.

These product lines have been chosen considering:

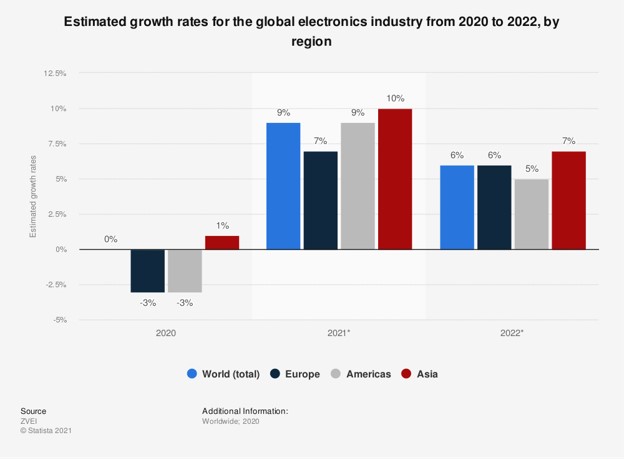

Electronics industry by region - growth outlook 2020-2022

In 2022, the electronics industry in Asia is expected to grow by around seven percent year-on-year. The market is expected to continue the recovery from its slump in 2020 when the market contracted by three percent, compared with 2019. The market was valued at around 880 billion euros in 2019, accounting for roughly 20 percent of the global market, which was sized at 4.6 trillion euros in 2019.

Source: Statista an established and a leading provider of market and consumer data

The COVID-19 pandemic forced people around the world to work, learn, and spend their time at home, driving the demand for consumer electronics. However, due to the global shortage of chips and disruptions to supply chains, many electronics products continue to be in short supply. Therefore, the global electrical and electronics industry did not grow in 2020 compared with the previous year. As problems related to COVID-19 are increasingly being addressed, the industry is expected to experience a period of growth in 2021 and 2022. Between 2020 and 2021, the industry is projected to grow by nine percent, and between 2021 and 2022, the industry is expected to grow by six percent, Globally.

Source: Statista an established and a leading provider of market and consumer data www.statista.com

There is little argument that the impact of the pandemic has accelerated the pace of digital transformation. This shift has boosted the demand for electronic devices, whilst upon the easing of lockdowns many countries have seen increased consumer spending on consumer electronics. In addition, demand in the global automobile industry has also arisen, which will boost the auto electronics supply chain. This sudden demand has intensified shortages of semiconductors to a degree that countries in the EU, and the US are discussing to reduce reliance on Asian semiconductor production lines during the coming decade.

All this points towards the emergence of supply gaps created by boosted demand and new market niches during the post pandemic era, giving good news to all aspirant exporters in the sector

Potential exporters of Electrical and Electronic products and services are immensely benefited from the existing export credentials of the local industry, the product span that the industry already exports and the reputation Sri Lanka has gained as an attractive sourcing destination for global buyers.

Exporting to multiple destinations including Switzerland, Maldives, United States, United Kingdom, Hong Kong, Japan, China, Bangladesh, India, and Germany, the local Electrical and Electronic industry has built a reputation in the global markets as a destination to procure products and services of world class quality, and exceptional service delivery.

Key exports from Sri Lanka comprises of Noise suppression capacitors, Noise suppression coils, Seat belt sensors, Wire harness, Airbag sensors, Power suppliers and Inductors, Transformers, Electrical Panel Boards, Electrical Switches and sockets, Data Communication cables and Industrial plugs, machined mechanical components, Machined component assembly, Coil Windings on Non- Uniform bobbins, Cable harnessing, Surface mounted Printed Circuit Boards (EMS), Automotive Harnessing, Seat Belt Safety Sensor Harness for automobiles, Electrical Power cables, Enamelled Winding Wires, Telecommunication cables, LV Switch Boards & Modular Enclosures, IoT devices and prototypes, and Consumer electronics industry.

With already established supply credentials the tasks of identifying export markets, securing prospective buyers, and securing export orders have become that much easier

With its unique geo maritime location Sri Lanka has gained a reputation as an attractive transhipment and a logistical hub in the region. The proximity to growing and emerging markets in the Electrical and Electronic sector, coupled with the logistical capabilities the country possesses, Sri Lankan exporters have an opportunity many of the competing exporters from other countries would not have.